2-Step Verification is used on the TaxWise Support Site, COM, CCH iFirm, and other Small Firms Solutions. 2-Step Verification does not affect how you log in using TaxWise Desktop.

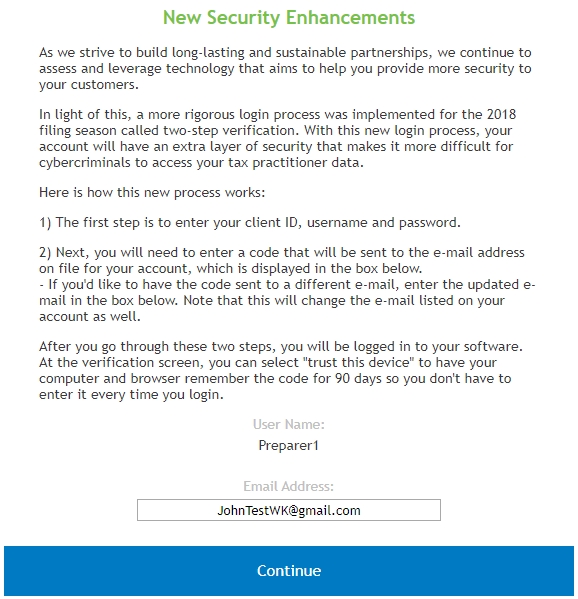

As we strive to build long-lasting and sustainable partnerships, we continue to assess and leverage technology that aims to help you provide more security to your customers.

In light of this, a more rigorous log in process was implemented for the 2018 filing season called two-step verification. With this log in process, your account has an extra layer of security that makes it more difficult for cybercriminals to access your tax practitioner data.

To log in using 2-step verification, use the following steps:

New Admin users will be prompted to change the password following the guidelines shown on-screen. Once you change the password, you should enter your email address and accept the license agreement. You will then be logged in. Follow the steps below for subsequent log ins.

The email address displayed is the one provided by your Admin when your user was created.

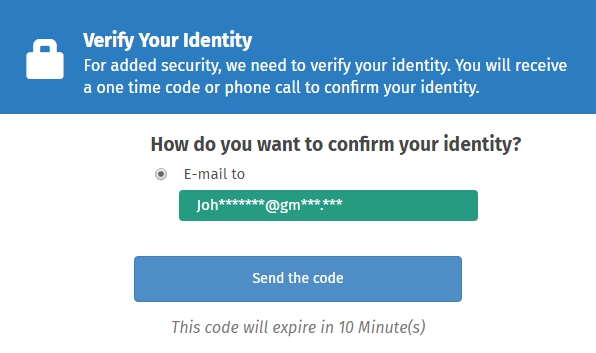

Request a code to be sent to the previously entered email address.

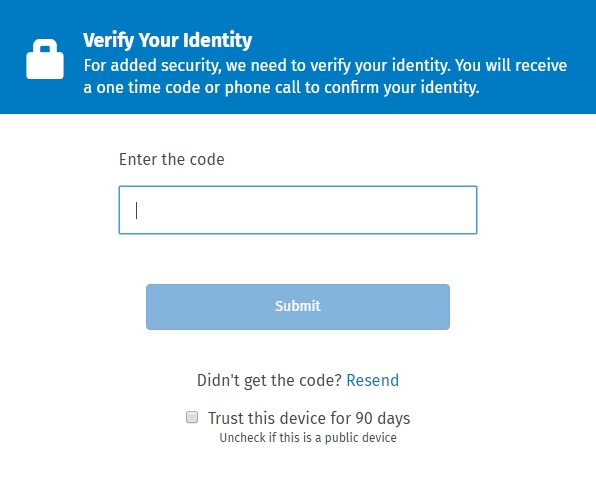

We highly recommend that you keep this new process enabled in order to provide additional assurance that all users are who they claim to be. However, as the Admin user, you can choose to opt out of this two-step verification for all users by going to Manage Users and clearing the Enable 2-Step Verification check box. Alternatively, at the verification screen, you can select “trust this device” to have your computer and browser remember the code for 90 days so you don't have to enter it every time you log in.

When two-step verification is turned off, all users will sign in with just their Client ID, username, and password.